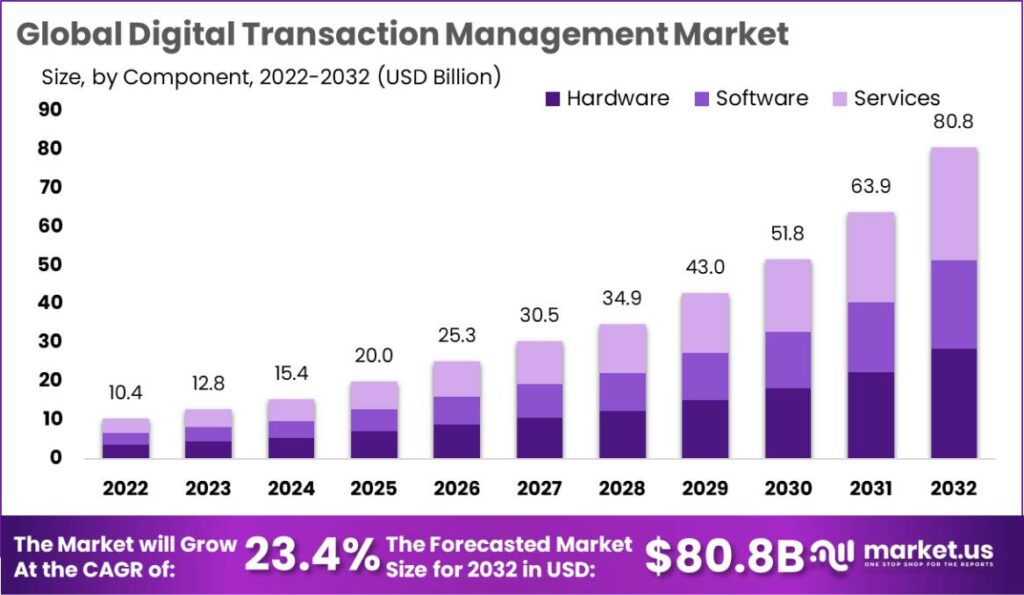

New York, Jan. 04, 2024 (GLOBE NEWSWIRE) — A recently released market.us study estimates that the global Digital Transaction Management Market will generate USD 12.8 billion in revenue in 2023 and is expected to increase at a compound annual growth rate (CAGR) of 23.4% from 2023 to 2032. The market is anticipated to reach USD 80.8 Billion by the end of 2032.

Digital Transaction Management (DTM) is a comprehensive approach to managing document-based transactions completely electronically. It encompasses various tools, technologies, and methods to facilitate secure, efficient document transactions. These transactions can include electronic signatures, workflow automation, and document authentication. By enabling businesses and individuals to manage, track, and securely store sensitive documents electronically, DTM aims to streamline operations, cut costs, improve accuracy, and enhance compliance. In essence, it replaces paper-based processes with a fully digitalized ecosystem that moves faster and is more reliable and secure.

To Gain greater insights, Request a sample report @ https://market.us/report/digital-transaction-management-market/request-sample/

The global market for Digital Transaction Management is experiencing significant growth and transformation. Factors such as increased focus on workflow automation, a surge in mobile transactions, and growing regulatory compliance needs are some of the key drivers behind the expansion of the DTM market. With businesses undergoing digital transformations globally, the need to automate and streamline transactions has led to the wide adoption of DTM solutions.

Additionally, various industries like healthcare, finance, real estate, and government sectors are increasingly adopting these solutions to improve operational efficiency and ensure security and compliance. Moreover, advancements in cloud computing and integration capabilities make DTM systems more accessible and cost-effective, even for small and medium-sized businesses. Companies operating in this space are also undergoing mergers, acquisitions, and collaborations to enhance their service offerings and expand their geographic reach. As organizations continue to embrace remote working conditions, especially after the COVID-19 pandemic, the demand for Digital Transaction Management systems is expected to grow even more rapidly.

Key Statistics

- The Digital Transaction Management (DTM) Market is valued at USD 12.8 billion in 2023. It is projected to reach USD 80.8 billion by 2032, with a CAGR of 23.4%.

- On the Basis of Component, the Hardware segment leads the market with a major revenue share of 40.3%

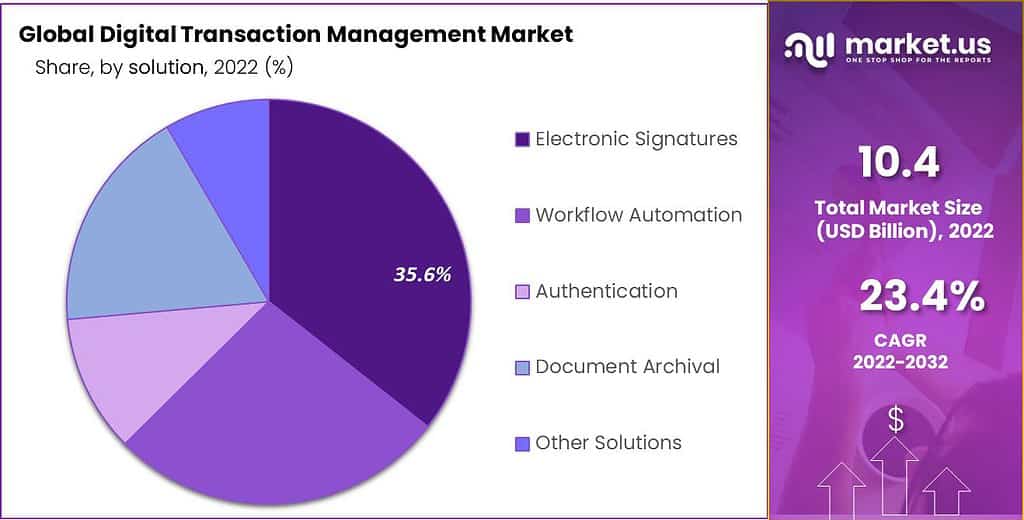

- Based on Solution, Electronic Signatures dominates the market with a major revenue share.

- On the Basis of Enterprise Size, Large Enterprises hold a major revenue share of 52.3% to dominate the market.

- Based on Industry Vertical, the BFSI segment dominated the market with a major revenue share of 28.2%.

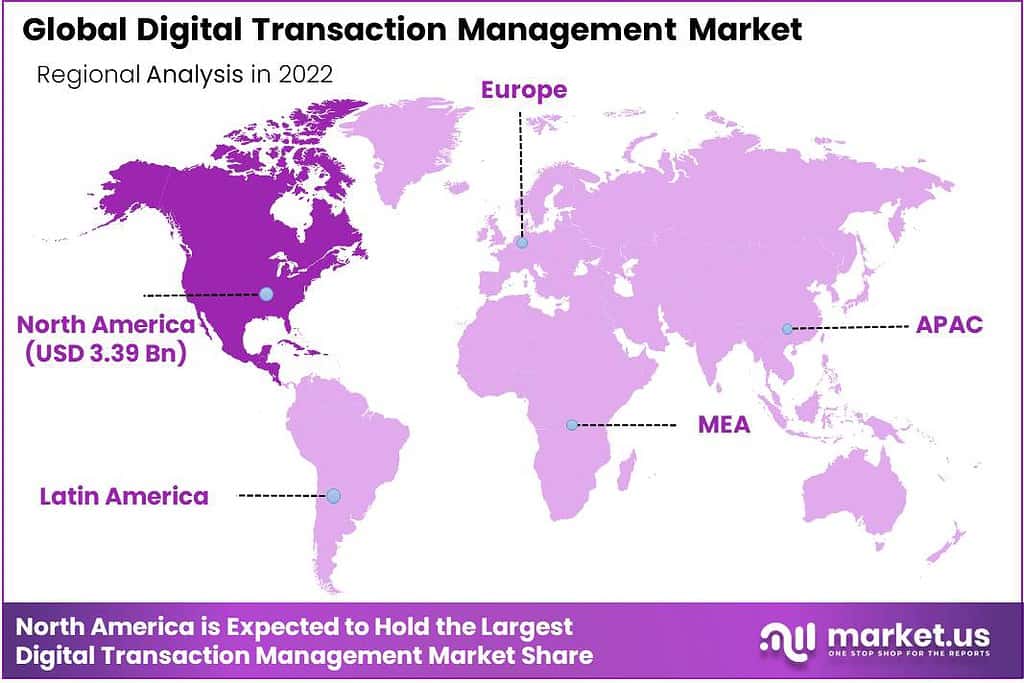

- Based on Region, North America leads the market with a major revenue share of 32.6%.

- Asia Pacific will grow at the fastest CAGR rate from 2023-2032.

Factors Affecting the Growth of the Digital Transaction Management Market

- Digital Transformation: The rapid transformation towards digitalization across various sectors has played a pivotal role in driving the adoption of Digital Transaction Management (DTM). As businesses increasingly distance themselves from traditional paper-based procedures and manual workflows, they are actively seeking DTM solutions to digitize and optimize their transactional processes effectively. This shift underscores the growing significance of DTM in modernizing operational paradigms.

- Remote Work and Collaboration: The move toward remote work and the global trend of collaboration, expedited by the unforeseen COVID-19 pandemic, has created a strong demand for digital transaction tools. This heightened need is primarily due to the essential role played by DTM in enabling secure and effective processes for remote signing, approval, and sharing of various documents, contracts, and agreements. As such, DTM has become indispensable in facilitating seamless business operations amidst this transformative shift in work dynamics.

- Cloud-Based Solutions: Cloud-based Digital Transaction Management (DTM) solutions have witnessed a surge in demand owing to their exceptional scalability, seamless deployment capabilities, and universal accessibility. This burgeoning trend of embracing cloud technology has, in turn, acted as a catalyst for the accelerated expansion of the DTM market. These cloud-based DTM platforms allow businesses to adapt and scale their transaction management processes according to their evolving needs.

Place a Direct Order Of this Report @ https://market.us/purchase-report/?report_id=64605

For instance,

- Salesforce implemented digital transaction management (DTM), leading to significant improvements in their sales organization. The adoption resulted in a cost-saving of USD 20 per document and an impressive 60% reduction in turnaround times. Additionally, the integration of electronic signatures into their sales process proved highly impactful, with the average deal close time decreasing from around two days to an impressive 90% of deals closing within one day and 71% closing in just one hour.

- In a move to enhance digital experiences for customers, Raiffeisen Bank International (RBI) has introduced RaiConnect, a virtual branch service. This innovative offering includes a comprehensive suite of collaborative modules and ePaper workflows, developed in partnership with Moxtra. The aim is to provide customers with a seamless and interactive digital banking experience through the virtual platform.

- Blockchain technology offers a sequence of timestamped data records structured as a chain that interconnects all associated documents. Each transaction within this chain serves as proof of consent, signifying user authorization through digital signatures. Digital transaction management solutions leveraging blockchain technology utilize a decentralized network for transaction management, effectively safeguarding against malicious attacks and enhancing the security of the entire process.

Top Trends in the Global Digital Transaction Management Market.

Electronic signatures have become widely embraced as a dependable and legally binding method for remotely signing documents. Businesses progressively incorporate e-signature functionalities into their Digital Transaction Management (DTM) solutions to simplify and expedite approval processes. This adoption reflects the recognition of the convenience and efficiency of electronic signatures in today’s digital landscape. Whether it’s contracts, agreements, or other important documents, signing them electronically saves time and ensures compliance with legal requirements, making it a fundamental component of modern DTM strategies.

Market Growth

The construction industry has witnessed remarkable growth in the adoption of Generative AI, and experts foresee this trend persisting in the coming years. Generative AI is a technology that harnesses the power of machine learning and neural networks to generate designs, conduct simulations, and propose solutions, promising transformative changes within the construction sector.

Regional Analysis

In 2022, North America asserted its dominance in the global market, accounting for a significant revenue share of more than 32.6%. The region’s strong position can be attributed to the presence of key market players and the emergence of innovative companies offering digital transaction management solutions.

Moreover, North America has gained recognition for its early adoption of advanced digital solutions in transaction management, further solidifying its substantial contribution to the global market. Additionally, Asia Pacific is on track to become the fastest-growing regional market during the forecast period. This rapid growth is primarily linked to increasingly adopting digital transaction management solutions in developing nations such as India and China.

Request Sample Report and Drive Impactful Decisions: https://market.us/report/digital-transaction-management-market/request-sample/

Competitive Landscape

The competitive landscape of the Market has also been examined in this report. Some of the major players include:

- Adobe

- DocuFirst

- DocuSign Inc.

- OneSpan

- HelloSign

- SignNow

- SignEasy

- itro Software

- AssureSign

- Zoho Sign

- Nintex UK Ltd

- ZorroSign, Inc.

- SunGard Signix Inc

- PandaDoc

- Topaz Systems Inc.

- Other Key Players

Things to know

| Report Attributes | Details |

| Market Value (2023) | US$ 12.8 Billion |

| Dimensions Value 2032 | US$ 80.8 Billion |

| CAGR (2023 to 2032) | 23.4% |

| North America Revenue Share | 32.6% |

| Biggest market | BFSI (Banking, Financial Services, and Insurance) sector |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

Market Drivers

Digital Transaction Management (DTM) simplifies operational procedures by converting and automating the handling of documents. This increased effectiveness stands as a key force behind its acceptance. DTM trims down the time and energy needed for duties such as making documents, endorsing them, and granting consent. This not only hastens transactions but also heightens the general output. Workers can allocate their attention to more critical chores rather than getting swamped in paperwork, resulting in financial savings and an improved competitive stance for corporations. Additionally, the capability to reach and control documents from afar encourages cooperation among teams dispersed across different geographical locations, further boosting productivity.

Market Restraints

One of the primary limitations of Document Transaction Management (DTM) is the ongoing worry regarding data security. DTM systems handle sensitive and private documents and transactions. The continuous concern is the fear of data breaches, cyberattacks, and unauthorized access. This requires strong security measures, encryption methods, and adherence to data protection laws such as GDPR and HIPAA. Organizations must allocate substantial resources to enhance cybersecurity and reduce these threats, which can strain their budgets.

Market Opportunities

Digital Transaction Management (DTM) provides substantial advantages to the financial services sector. Banks, credit unions, and fintech companies can incorporate DTM into their operations to simplify tasks such as initiating new accounts and approving loans, all while improving the overall customer experience. DTM automates the handling of documents, leading to cost reductions. Furthermore, it facilitates quicker and more secure international transactions. The surge in online banking adoption due to the impact of COVID-19 has created an ideal environment for integrating DTM. DTM service providers can customize solutions to align with the compliance and security requirements of the financial industry, presenting an appealing prospect for enhancing efficiency and growth within the sector.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Report Segmentation of the Digital Transaction Management Market

Component Analysis

In 2022, the hardware sector dominated the market with a 40.3% revenue share, driven by the increased demand for sophisticated Point of Sale (POS) machines for inventory tracking and sales monitoring. Electronic signature pads and contactless technologies like NFC also contributed to hardware growth. Meanwhile, the software segment is expected to experience the fastest growth, particularly Contract Lifecycle Management (CLM) software, which facilitates digital transaction management by enabling legally compliant electronic signatures, document flow management, and secure data handling. Cloud-based capabilities further enhance business processes in this software segment.

Solution Analysis

In 2022, the electronic signatures sector dominated the market with over 35.6% revenue share due to vendors launching comprehensive electronic signature solutions, enhancing operational efficiency, and reducing business costs. The segment with the highest growth potential in the forecast period is workflow automation, allowing businesses to save time and resources while reducing the risk of errors, leading to significant financial losses. This trend is driving increased adoption of workflow automation solutions in organizations.

Enterprise Size Analysis

In 2022, large enterprises held over 52.3% of the market share, primarily because they needed efficient transaction workflows and cost-effective processes. They favored digital transaction management solutions for their ability to handle transactions and documents effectively, improve authentication, and facilitate collaboration among reviewers. Small and medium-sized enterprises (SMEs) are expected to grow rapidly in this sector as they adopt digital transaction management solutions, shifting from traditional methods. SMEs are also increasingly using Artificial Intelligence (AI) to reduce risks and administrative costs, highlighting the importance of technology in this field.

Industry Vertical Analysis

In 2022, the BFSI sector (Banking, Financial Services, and Insurance) led the market with a 28.2% revenue share, driven by the rapid adoption of cloud-based digital transaction management solutions. These solutions help banks and financial institutions enhance agility and address competition, demanding customers, and evolving regulations. The government sector is expected to grow rapidly as governments worldwide embrace digital transaction management for efficient governance. They collaborate with vendors to develop tailored solutions with advanced algorithms and high-level security for secure record-keeping and transparent governance.

Market Segmentation

Component

- Hardware

- Software

- Services

Solution

- Electronic Signatures

- Workflow Automation

- Authentication

- Document Archival

- Other Solutions

Enterprise Size

- SMEs

- Large enterprises

Industry Vertical

- Retail

- IT & Telecom

- Healthcare

- Government

- BFSI

- Other Industry Verticals

By Geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Recent Developments

- In November 2022, Nigerian fintech company Pivo secured $2 million in seed funding. The funds will be used to expand current products, create new solutions for digital transaction management in the supply chain, expand operations into East Africa, and increase the size of their team.

Explore More Reports

- The business process outsourcing market is expected to grow by USD 544.8 billion in 2032, registering a CAGR of 8.5%.

- Testing, Inspection and Certification Market is projected to be USD 224.9 Bn in 2022 to reach USD 349.3 Bn by 2032, at a CAGR of 4.5%.

- The digital identity solutions market was valued at US$ 28 Bn and is projected to reach US$ 131.6 Bn by 2032, with the highest CAGR of 17.2%.

- HR Analytics Market is likely to top a valuation of USD 9.9 billion in 2032 at a CAGR of 13.4% between 2023 and 2032.

- Generative AI in Marketing market is valued at USD 1.9 bn in 2022. With a CAGR of 28.6%, the market is set to reach US$ 22.1 bn by 2032

- Cyber Security Market size is expected to be worth around USD 533.9 Billion by 2032, growing at a CAGR of 11% during the forecast period.

- Thin Client Market with a projected CAGR of 2.0%, the market is set to reach USD 1.7 billion by 2032; showcasing its immense potential.

- Smart Homes Market is expected to reach USD 503.1 billion, this market is estimated to register the highest CAGR of 16.8%

- Workforce Management Market was valued at USD 9 bn in 2023 and is expected to reach USD 19.8 billion by 2032, highest CAGR of 9.3%.

- In 2022, Contact Center as a Service Market was at USD 4.7 Bn. It is estimated to reach USD 23.6 Bn in 2032 at a CAGR of 18% from 2023-32.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: