NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, British Columbia, Oct. 23, 2024 (GLOBE NEWSWIRE) — Nevada King Gold Corp. (TSX-V: NKG) (“Nevada King” or the “Company”) is pleased to announce that the Company has entered into an agreement with Desjardins Capital Markets (“Desjardins”) on behalf of a syndicate of agents (the “Agents”) in connection with the private placement offering of up to 29,411,764 common shares (the “Common Shares”) of the Company at a price of $0.34 (the “Offer Price”) per Common Share for aggregate gross proceeds to the Company of up to $10,000,000 (the “Offering”).

The net proceeds of the Offering are intended to be used to advance Nevada King’s Atlanta Gold Mine Project and for general corporate purposes.

The Common Shares to be issued under the Offering are expected to be offered for sale on a commercially reasonable “best efforts” fully marketed basis primarily by way of the Listed Issuer Financing Exemption (“LIFE”) under Part 5A of National Instrument 45-106 – Prospectus Exemptions (“NI 45-106”) to purchasers in all the provinces and territories of Canada, except Québec. Any Common Shares offered pursuant to the LIFE under the Offering will not be subject to resale restrictions pursuant to applicable Canadian securities laws or the policies of the TSX Venture Exchange (“TSX-V”).

Subject to compliance with applicable regulatory requirements and in accordance with NI 45-106, the Common Shares will also be offered to “accredited investors” pursuant to applicable exemptions from the prospectus requirements under applicable Canadian securities laws, and in other qualifying jurisdictions. All Common Shares issued pursuant to the Offering other than those issued pursuant to the LIFE will be subject to a hold period under Canadian securities law expiring four months and one day after the closing date.

There is an offering document related to the LIFE that can be accessed under the Company’s profile at www.sedarplus.ca and on the Company’s website at www.nevadaking.ca. Prospective investors should read this offering document before making an investment decision.

The Agents will receive a cash fee of up to 5.0% of the gross proceeds of the Offering other than in respect to sales to certain insiders of the Company for which the Agents will receive no fee and in respect of sales to certain purchasers on the President’s List for which the Agents will receive a fee of 2.0%.

Closing of the Offering is anticipated to occur on or about of November 13, 2024, or such other date as the Agents and the Company may agree upon. The issuance of the Common Shares under the Offering and the payment of the Agents’ commission are subject to customary conditions, including, but not limited to, the negotiation of an agency agreement between the parties and the receipt of all necessary approvals, inclusive of the approval of the TSX-V.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This release does not constitute an offer to sell or a solicitation of an offer to buy of any securities in the United States. The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities laws or pursuant to available exemptions therefrom.

Related Party Participation in the Offering

Certain insiders of the Company, including Collin Kettell (CEO and Director), expect to participate in the Offering. The participation by insiders in the Offering constitutes a “related party transaction” as defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair market value of the Common Shares purchased by insiders, nor the consideration for the Common Shares paid by such insiders, will exceed 25% of the Company’s market capitalization. The Company expects that the closings of the Offering will occur within 21 days of this announcement and that it will not file a material change report in respect of the related party transaction at least 21 days before the closings. The Company deems this circumstance reasonable in order to complete the Offering in an expeditious manner. The Offering has been unanimously approved by the Company’s board of directors. Further information regarding the interest in the Offering of every related party and the effect that the Offering will have on their percentage of securities of the Company will be provided once finalized.

About Nevada King Gold Corp.

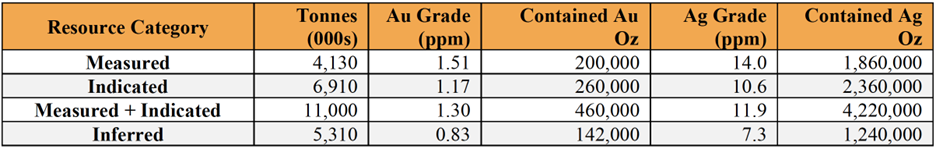

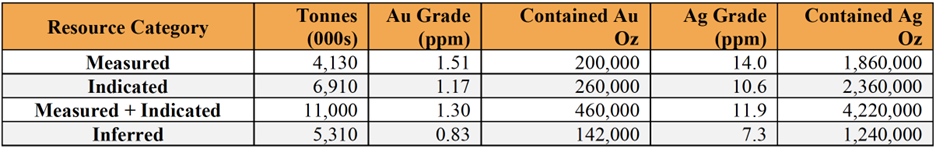

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR+ (www.sedarplus.ca).

Table 1. NI 43-101 Mineral Resources at the Atlanta Mine

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., Qualified Person as defined by NI 43-101.

Please see the Company’s website at www.nevadaking.ca.

For further information, contact Collin Kettell at collin@nevadaking.ca or (845) 535-1486.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, statements in respect of the size and use of proceeds of the Offering, the timing and ability of the Company to close the Offering, including obtaining approval of the Offering from the TSX-V. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f36f33d7-76f5-4efa-8764-fadf0c1f4eff