Dublin, Jan. 18, 2024 (GLOBE NEWSWIRE) — The “Global Electric Construction Equipment Market by Equipment Type, Battery Capacity, Battery Chemistry, Power Output, Application, Propulsion, Electric Tractor Market, Electric Construction & Mining Equipment and Region – Forecast to 2030” report has been added to ResearchAndMarkets.com’s offering.

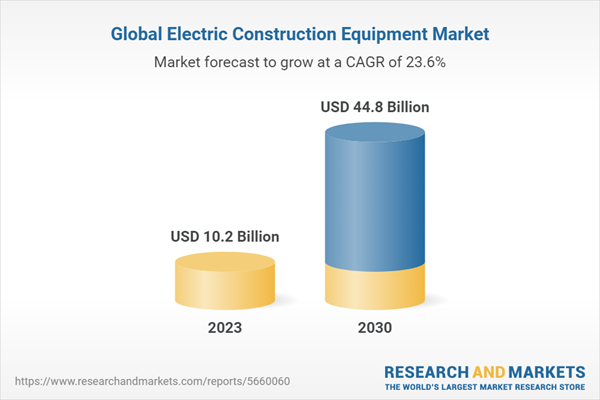

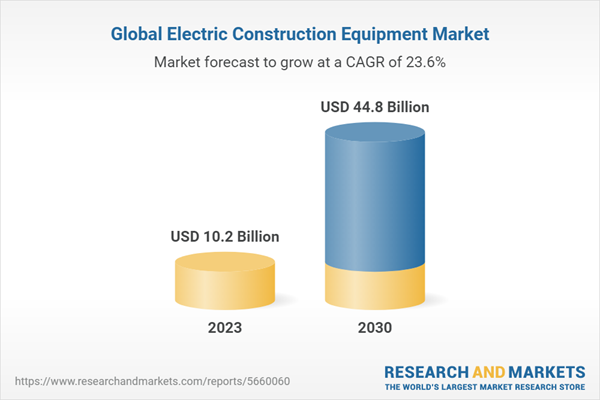

The global electric construction equipment market is projected to grow from USD 10.2 billion in 2023 to USD 44.8 billion by 2030, at a CAGR of 23.6%

All key countries have established programs/regulations for GHG emissions in the transportation industry. To follow the government mandates and the associated costs, the manufacturers and customers opt for an alternative sustainable mode of mobility. This greatly aided the development of hybrid and electric construction equipment, which are more efficient, emission-free, and noise-free than their IC engine counterparts.

European countries like Germany, the UK, France, Spain, Italy, Russia, and others are pivotal players in the electric construction equipment market, positioning Europe as the largest region. Municipal corporations in this region increasingly prioritize emission and noise reduction in urban construction, fueling the demand for electric equipment.

In Germany, several factors drive the electric construction equipment surge, notably zero-emission zones in cities and the rising demand for sustainable construction and mining gear. Fendt, Farmtrac, and Multi-Tool Trac unveiling electric tractor prototypes at events like the Machinery Show signify the industry’s innovation. Deutz AG, Fendt, Stihl Holding AG & Co. KG, and Wacker Neuson SE are key players shaping this market.

Additionally, by producing zero on-site emissions, electric machinery minimizes the need for extensive ventilation systems to clear exhaust fumes, directly reducing ventilation costs. This cost-effectiveness and environmental advantage position electric construction equipment as an appealing solution for mining operations seeking to lower overheads and comply with stringent environmental regulations. Consequently, the potential for reduced operating costs and improved environmental performance will likely accelerate the market demand for electric construction equipment.

The key players in the electric construction equipment market are Hitachi Construction Machinery (Japan), Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Deere & Company (US). Major companies’ key strategies to maintain their position in the global electric construction equipment market are strong global networking, mergers and acquisitions, partnerships, and technological advancement.

The battery electric equipment will lead the market due to the stringent noise and emission regulations

The rapid evolution of battery technology is propelling the growth of battery electric equipment. These advancements enable longer operational durations without recharging, making them increasingly viable for uninterrupted construction operations. The stringent noise regulations around the globe outline specific hours for construction work, limiting noisy tasks and emphasizing compliance under the Pollution Control Act.

For instance, the UK enforces specific hours for construction work to mitigate noise disturbances, guided by the Pollution Control Act. Acts like the Environmental Protection Act empower councils to tackle noise concerns and establish action plans for targeted areas. Additionally, residential areas follow guidelines where nighttime noise levels exceeding 34 decibels above the background are considered unreasonable.

Battery electric machinery’s more straightforward design compared to hybrids results in lower maintenance and operational costs, presenting an attractive, cost-effective solution for construction companies aiming to optimize expenditure. Driven by escalating environmental concerns and stringent regulations, the rising demand for zero-emission equipment favors battery electric options, aligning seamlessly with regulatory mandates and customer preferences for eco-friendly solutions.

Volvo Construction Equipment and Portable Electric have teamed up to provide mobile charging solutions for electric construction equipment. The Voltstack 30k from Portable Electric offers 30 kW power output and 80 kWh battery capacity, rechargeable via the grid, solar arrays, or diesel gensets. This partnership aims to reduce carbon footprints on construction sites by bundling the Voltstack 30k with Volvo CE’s electric equipment purchases at their North American dealer locations, ensuring efficient and emission-free charging options for noise-sensitive environments.

These ongoing improvements in charging infrastructure are gradually mitigating the limitations associated with battery electric equipment, such as charging times and accessibility. This enhancement in infrastructure further enhances the appeal of battery electric choices within the construction sector.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 408 |

| Forecast Period | 2023 – 2030 |

| Estimated Market Value (USD) in 2023 | $10.2 Billion |

| Forecasted Market Value (USD) by 2030 | $44.8 Billion |

| Compound Annual Growth Rate | 23.6% |

| Regions Covered | Global |

Recommendations

- Asia-Pacific to be Potential Market for Electric Construction Equipment

- Hydrogen-Fueled Construction Equipment to Create New Opportunities

- Electrification of Underground Mining Equipment to be Significant for Oems

- Rental Electric Construction Equipment and Telematics to Drive Market

- Growth of Autonomous Tractors in Future

- Lithium-Ion Battery Chemistry to Dominate Electric Construction Market

Case Studies

- Use of Electric Mining Vehicle in -30Oc Temperature

- Achieving Carbon Neutrality with New Fuel Source and Battery System

- City Waste Management Using Electric Mobility

- Replacement of Diesel Trucks with Electric Models at Brucejack Site

- Electrification of Conventional Diesel-Powered Excavator

- Improved Fuel Efficiency with Electric Hybrid Wheel Loader

Market Dynamics

Drivers

- Strict Vehicular Emission Regulations

- High Ventilation Costs in Underground Mining

- Rising Demand for Low-Noise Construction Activities in Residential Areas

Restraints

- Higher Initial Cost Than Conventional Ice Equipment

- Loss of Productivity due to Prolonged Charging Time

- Complex Charging Infrastructure for Electric Construction Machinery

Opportunities

- Development of Long-Range and Fast-Charging Battery Technology

- Increased Manufacturing and Testing of Hybrid Electric Vehicles

- Emergence of Hydrogen-Powered Construction Equipment

Challenges

- Limited Compatibility, Interchangeability, and Standardization of Electric Construction Equipment for Long-Haul Applications

- Complex Thermal Management of Batteries

- Rapid Transition of Construction Equipment Toward Alternative Power Sources

Trade Analysis

- Import Data: Dozers

- Export Data: Dozers

- Import Data: Excavators and Loaders

- Export Data

Trends and Disruptions Impacting Customer Business

- Revenue Shift and New Revenue Pockets for Electric Construction Equipment Market Players

Technology Analysis

- Autonomous Construction Equipment

- Monitoring and Diagnosis Via Connected Technologies

- Grade Control Systems

- Safer Braking in Deep Mining Sites with Regenerative Braking

- Agricultural Equipment Automation

- Advanced Telematics in Equipment

Electric Construction Equipment: Battery Technology

- Electric Construction Equipment: Battery Manufacturers

- Future Developments in Battery Technology

- Solid-State Batteries

- Lithium-Ion Batteries

- Sodium-Ion Batteries

- Battery Chemistries

Company Profiles

Key Players

- Hitachi Construction Machinery Co., Ltd.

- Caterpillar Inc.

- Komatsu Ltd.

- Jcb

- Volvo Construction Equipment

- Deere & Company

- Sandvik Ab

- Epiroc Ab

- Liebherr

- Doosan Group

Other Players

- Soletrac Inc.

- Dana Limited

- Deutz Ag

- Fendt

- Husqvarna Ab

- Stihl Holding AG and Co. Kg

- Xuzhou Construction Machinery Group Co., Ltd. (Xcmg) Group

- Sany Heavy Industries Co., Ltd.

- Kubota Corporation

- Kobelco Construction Machinery Europe Bv

- Bharat Earth Movers Limited

- Crrc Corporation

- Cnh Industrial Nv

- Wacker Neuson Se

- Takeuchi Global

- Hd Hyundai Heavy Industries Co., Ltd.

- Luigong Machinery Co., Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/969ai3

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment