The exchange is considering a share sale within two years, though it has yet to reach a decision.

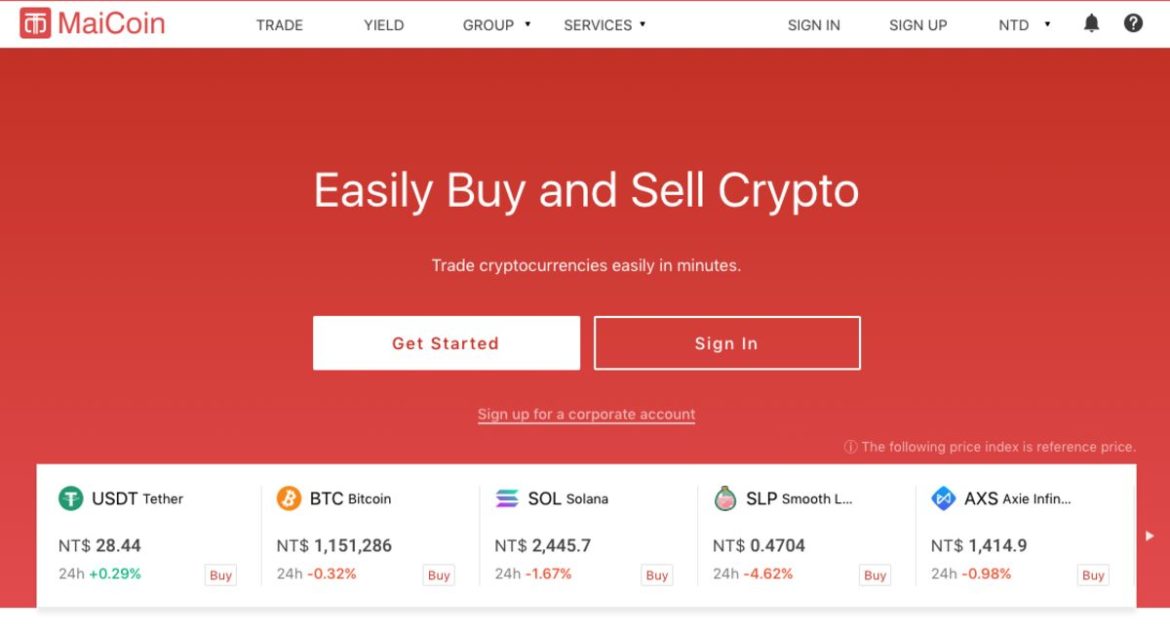

MaiCoin, a crypto exchange based in Taipei, is considering selling shares on Nasdaq within two years, Bloomberg reported, citing people with knowledge of the matter. A definitive decision, however, has yet to be made.

The exchange is completing a Series C funding round that may value the company at $400 million, Bloomberg said.

The exchange makes the majority of its revenue from Taiwan, according to publicly available figures. It counts Taishin Venture Capital, a subsidiary of Taiwan’s Taishin Bank, as one of its investors.

Traders on the exchange are able to use the Taiwan dollar through domestic bank transfers. They can also buy crypto at many convenience stores.

MaiCoin expects trading revenue to rise more than 70% annually through 2025, documents reviewed by Bloomberg showed.

MaiCoin’s MAX exchange pushes around $20.4 million trading volume a day according to data from CoinGecko.

A Taiwan dollar stablecoin project is also being backed by MaiCoin, but regulatory challenges from the island’s Central Bank may hamper its development.