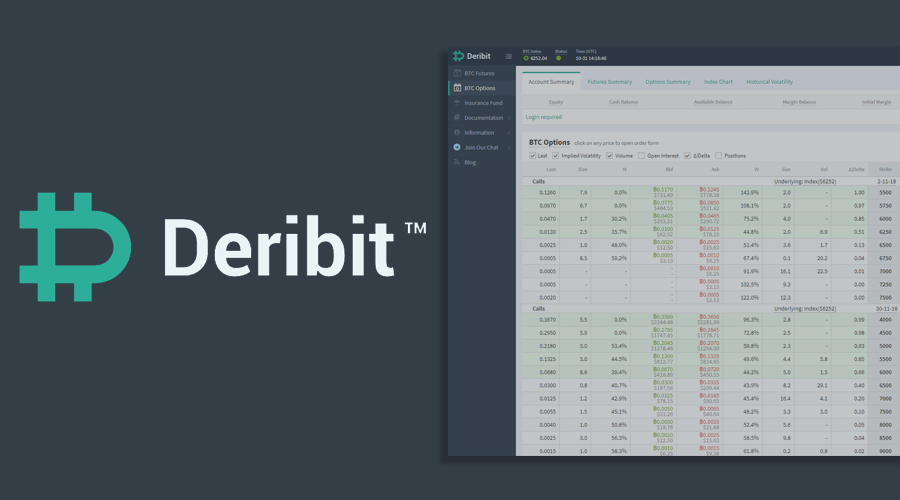

Deribit controls over 85% of the global crypto options market.

Deribit, the world’s leading crypto options exchange by trading volume and open interest, will soon offer options tied to prominent alternative cryptocurrencies XRP, SOL and MATIC.

The exchange announced its expansion plan on X soon before press time, adding that it is seeking a brokerage license in the European Union (EU).

Options are derivative contracts that give the purchaser the right but not the obligation to purchase or sell the underlying asset at a predetermined price on or before a specific date. A call gives the right to buy while a put offers the right to sell.

The availability of XRP, SOL and MATIC options could boost liquidity in the wider alternative cryptocurrency market and will provide altcoin traders more flexibility in managing their risks. Historically, altcoin traders have relief on ether and bitcoin options to hedge their altcoin exposure.

Deribit’s existing product suite includes options and perpetual futures tied to bitcoin, ether and volatility futures. The exchange’s bitcoin and ether options are popular among traders looking to hedge their portfolios and bet on volatility. In September, the exchange accounted for 86% of the global crypto options market.