Traders are losing big money on the recently-issued token.

Traders of futures tracking ApeCoin (APE) lost over $4.5 million in the past 24 hours as prices surged by 13% amid a broader market jump, data from tracking took Coinglass show.

Some 66% of all APE futures traders were short, or betting against higher prices, the recently-issued token. These accounted for $2.81 million of all losses, while $1.44 million were long, or betting on higher prices.

APE traded at the $13.88 level on Sunday night, surging over $15.44 in early Asian hours on Monday. APE was issued on Mar. 17 and saw listings on several influential crypto exchanges, such as Coinbase. Prices were volatile in the days afterward, rising as much as 90% after sinking 80%.

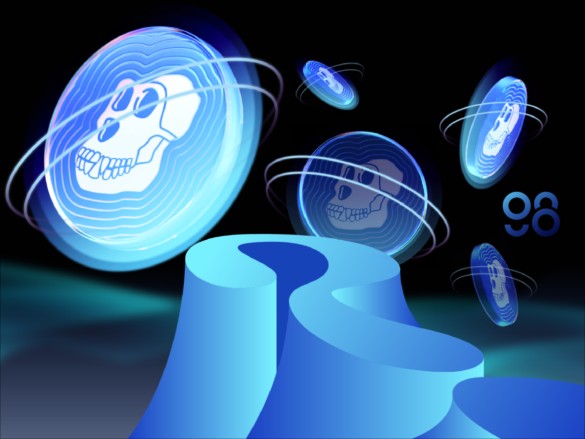

APE is the governance token of the ApeCoin DAO, a community-led organization to manage the Bored Ape Yacht Club (BAYC) ecosystem. BAYC is one of the most popular NFT projects with a market capitalization of over $3.4 billion.

Crypto exchange Binance processed over $1 billion in volume on APE futures, the most among all crypto exchanges. Bybit, however, saw the most losses on APE liquidations at nearly $1 million. Liquidation happens when a trader has insufficient funds to keep a leveraged trade open.

Prices of APE fell since Monday’s highs to $14.83 at writing time as traders took profits.